What forex pairs to watch when risk increases

The S&P volatility index, VIX, has hit highs this month last seen in May. The index is commonly known as a fear gauge for US stocks as it measures uncertainty in the S&P.

What are risk-off assets?

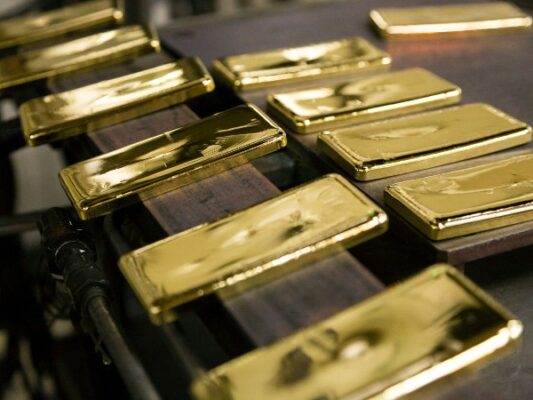

Risk-off assets are investment vehicles that tend to appreciate when risky assets like stocks are declining. Traders tend to move towards “safer” assets in times of uncertainty in attempt to avoid large losses. Examples of risk-off assets include gold, bonds and certain currencies.

US dollar and Japanese yen are historically seen as flight-to-quality or safe haven currencies that hold strong in times of fear and added volatility. Strong liquidity and stable political systems are common factors that give traders reason to believe in a currency’s stability.

Given the current economic landscape, USD and JPY have different potential draw factors as safety currencies. The US has a strong economy with recent dollar strength, though any indication of a recession in the near future may seep into USD rather quickly. Japanese yen has been weak in 2023, though its distance from involvement in the war in Israel so far could leave its currency more immune to global events.

Traders may also look to AUD/USD given its historical correlation to the S&P 500. Long Australian dollar currently has a positive 0.5 correlation with the S&P, with hardly any negative correlation over the past 10 years. Following this line of reasoning, long USD in AUD/USD would be a risk-off strategy, while long AUD in AUD/USD would be risk-on.

This article was originally published by a www.ig.com

Read it HERE