US Housing Starts Surge 9.6% in August as Lower Mortgage Rates Boost Builder

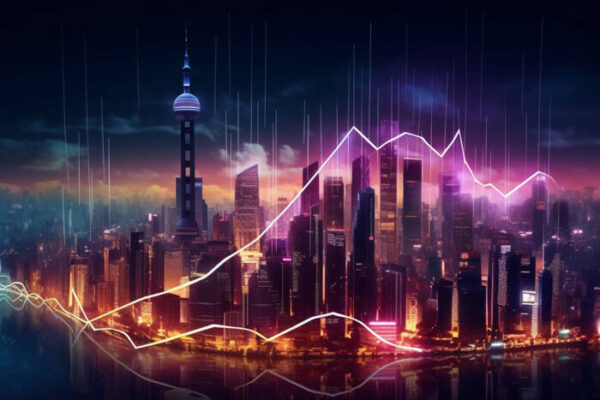

Anticipation of a recovery in the housing market has fueled investor interest in US homebuilders. The iShares US Home Construction ETF has risen by 20% over the past three months, hitting a record high. This reflects optimism that a combination of improving affordability and falling mortgage rates will ultimately lead to higher demand for new homes.

Regional Breakdown of Housing Starts

Regionally, housing starts surged 15.5% in the South, recovering from a slump caused by Hurricane Beryl in July, which had reduced construction to its slowest pace since mid-2020. The Midwest and West also reported gains in August, adding to the positive momentum in homebuilding activity.

Market Forecast: Mixed Outlook for Housing Starts

While the latest data points to an uptick in residential construction, experts remain cautious. According to Bloomberg Economics, builders are likely to remain conservative due to the high stock of unsold homes. They predict housing starts may continue to decline in the near term, with the potential for a more sustained recovery only after affordability improves further.

Overall, despite a positive bounce in August, the short-term outlook for housing starts remains neutral to slightly bearish, depending on the pace of Federal Reserve policy adjustments and how quickly mortgage rates stabilize.

This article was originally published by a www.fxempire.com

Read it HERE