Swiss Inflation Matching 2024 High Erodes Case for SNB Rate Cut

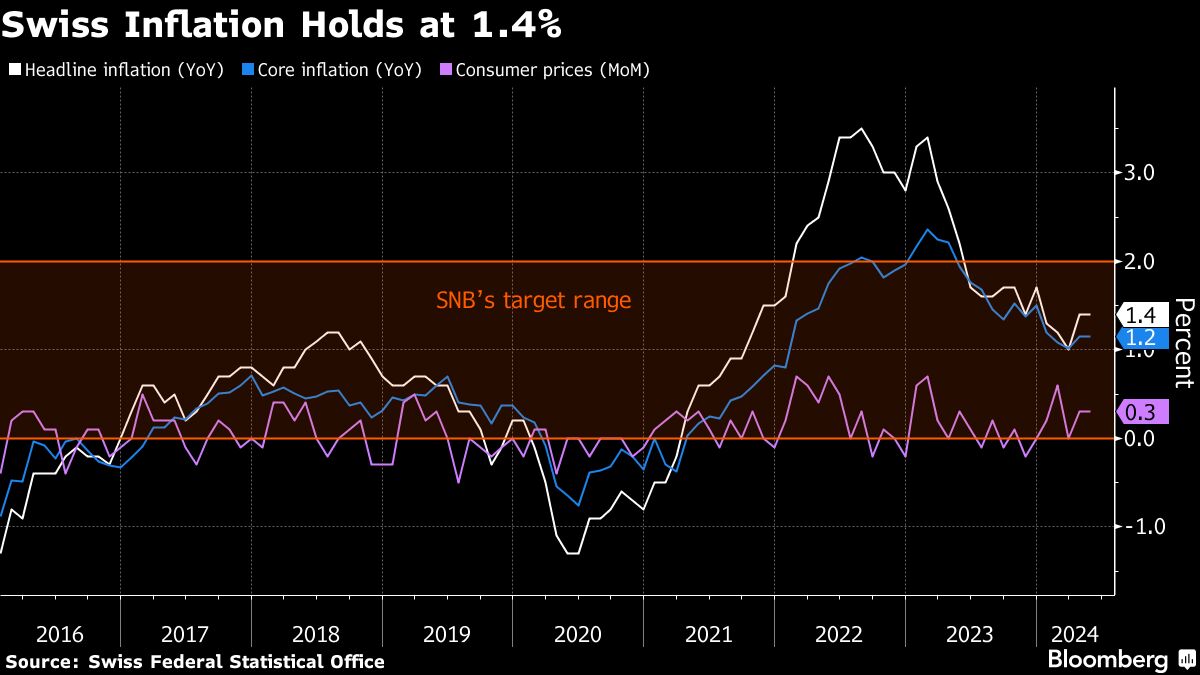

(Bloomberg) — Swiss inflation held at its fastest pace this year, eroding the case for a Swiss National Bank interest-rate cut when officials meet later this month.

Most Read from Bloomberg

Consumer prices rose 1.4% in May from a year earlier, Switzerland’s statistics office said on Tuesday. That advance — which is in line with economists’ estimates — matches April’s reading.

Rent, package holidays, fresh vegetables and petrol supported upward pressures, offset by heating oil, the statisticians said. Rent increases had been expected after previous central bank moves had raised a key reference rate.

While Tuesday’s number aligns with a 1.4% average the SNB anticipates for the second quarter, the central bank has at times overestimated inflation. That means a reading below the forecast would have supported another rate reduction.

“We now expect that the SNB will stay on hold at its June meeting,” Maeva Cousin of Bloomberg Economics wrote last week in a change to her previous forecast, citing robust economic growth and a weakening of the franc since officials last met.

Weighing against that narrative, the currency gained against the euro and the dollar in May, snapping a four-month losing streak on hawkish comments from SNB President Thomas Jordan.

He said that the most likely reason for faster Swiss inflation is a softer franc, which the central bank could counteract by selling foreign exchange — with some indicators suggesting it’s already intervening.

Switzerland still has one of Europe’s lowest inflation rates. Data from the euro area showed that prices rose an annual 2.6% there in May. Based on the European Union’s harmonized measure, Swiss inflation was 1.5% last month.

–With assistance from Naomi Tajitsu, Kristian Siedenburg and Joel Rinneby.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

This article was originally published by a finance.yahoo.com

Read it HERE