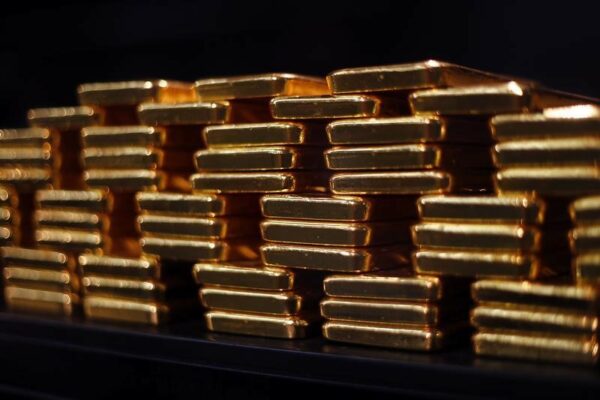

Saudi forex reserves at 18-month high

Dubai: Saudi Arabia’s foreign exchange reserves surged by almost 7 per cent this year to $445 billion (Dh1.6 trillion) in May, marking their highest level since November 2022. This increase provides the government with greater flexibility to invest in major projects that require substantial funding.

Saudi Arabia raised $17 billion (Dh62 billion) through debt markets, while the Public Investment Fund (PIF) generated around $15 billion (Dh55 billion) in cash by selling off US equities.

The government doubled PIF’s stake in Aramco to 16 per cent, ensuring a steady flow of dividends from the state oil giant. Despite a decline from their peak of nearly $740 billion (Dh2.7 trillion) in 2014, Saudi reserves have seen recent growth following a decrease last year, attributed to the government channeling funds to support economic reforms through PIF.

However, these projects are encountering delays due to oil prices remaining below budget thresholds and foreign investment falling short. Consequently, the government is exploring alternative funding options.

The Saudi investment strategy increasingly revolves around PIF, which has assets under management totaling $925 billion (Dh3.3 trillion) as of June, while the central bank has decreased its holdings in US Treasuries.

The International Monetary Fund (IMF) noted in its recent report that Saudi forex reserves will remain substantial, providing approximately 13 months of import cover, supported by additional buffers from PIF and other government-related entities.

This article was originally published by a gulfnews.com

Read it HERE