Nasdaq Index, Dow Jones, S&P 500 News: Apple Surges on AI Potential, Indian

Apple shares gained 2% after Loop Capital upgraded the technology giant to a buy rating, citing its upcoming and future AI integrations as an opportunity to become the generative AI “base camp” of choice. Bloomberg News also reported that Apple’s sales in India grew 33% year over year through March to a record $8 billion.

At 12:32 GMT, Dow futures are trading 40513.00, up 212.00 or +0.53%. S&P 500 Index futures are at 5689.00, up 24.25 or +0.43% and Nasdaq 100 Index futures are trading 20626.50, up 102.50 or +0.50%.

Trump Assassination Attempt Impacts Markets

The failed assassination attempt on Trump, the Republican presidential candidate, has potential market implications. Investors speculate it could boost Trump’s poll numbers ahead of the November election. Sam Stovall, chief investment strategist at CFRA Research, stated, “The market will continue on its momentum ways.” Shares of insurers Humana and UnitedHealth Group gained in premarket trading, potentially benefiting from reduced cost pressures under a Republican administration.

Earnings Season Kicks Off

Investor focus is shifting to second-quarter earnings reports. Over 40 S&P 500 companies are set to report this week, including Bank of America, United Airlines, and Netflix. Goldman Sachs shares rose after posting better-than-expected earnings, following a trend set by major banks to start the reporting season.

Notable Stock Movements

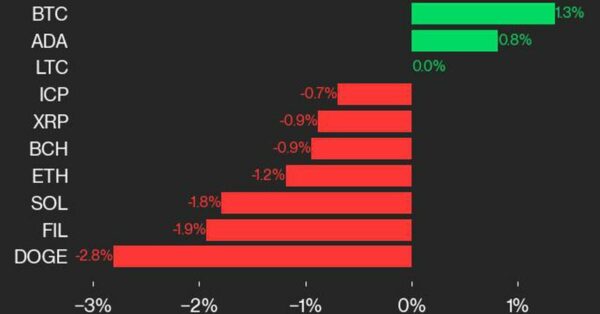

Trump Media & Technology surged over 50% following the assassination attempt. Super Micro Computer rose 3.6% on news of its inclusion in the Nasdaq 100 index. Cryptocurrency-related stocks, including Coinbase, Marathon Digital, and Riot Platforms, jumped as Bitcoin and Ethereum prices increased. SolarEdge Technologies shed about 9% after announcing plans to lay off 400 employees. Tesla stock rose 4%, building on a more than 25% gain so far this month.

Market Forecast

The market outlook appears bullish in the short term, driven by strong earnings expectations and potential political shifts.

This article was originally published by a www.fxempire.com

Read it HERE