Japan’s stock market rally will go on, but with a key shift: BlackRock

The rally for Japanese stocks is set to continue in the second half of the year, but the best way for American investors to participate in it could change, according to the BlackRock Investment Institute. The firm said in its midyear outlook that being overweight on Japanese stocks is one of its highest conviction calls. Wei Li, the global chief investment strategist at the institute, said at a media event Tuesday that the firm thinks Japanese stocks can grow earnings faster than the 7.5% consensus expectation in the year ahead. “We do think the micro case for Japanese equities remains very strong,” Li said. Many Americans have already been rushing into funds that track Japanese stocks, part of a broader increase in foreign investor money . Broad-based Japanese exchange-traded funds in the U.S. have attracted about $4 billion from investors so far this year, according to FactSet. But one wrinkle to the BlackRock outlook is that the firm’s recommendation is more geared toward Japanese investments that are not currency-hedged. That is a notable distinction, since the historic slide for the yen against the U.S. dollar has caused major divergence among Japan-focused ETFs. For example, the firm’s iShares MSCI Japan ETF (EWJ) is up about 10% year to date but the Currency Hedged MSCI Japan ETF (HEWJ) is up 28.7%. Funds from other issuers show similar splits between the hedged and unhedged options. HEWJ YTD mountain Currency-hedged Japanese funds like the HEWJ are outperforming their unhedged counterparts in 2024. Li said the currency impact has been “really inconvenient” for many investors but that there are reasons to believe the yen will stabilize in the upcoming year, especially with national elections looming in 2025. “As we head into an election season … weaker currency is less helpful, and maybe we could expect some sort of intervention — if not outright direct intervention, that is kind of encouragement around repatriation, encouragement around foreign inflows, that could support the stabilization of the currency,” Li said. She also pointed out that rising interest rates in Japan could lead to more support for the yen. BlackRock is not alone in being bullish on Japan. Goldman Sachs Asset Management said in its midyear outlook that “in Japan, we expect strong equity market performance to continue being driven by structural changes.”

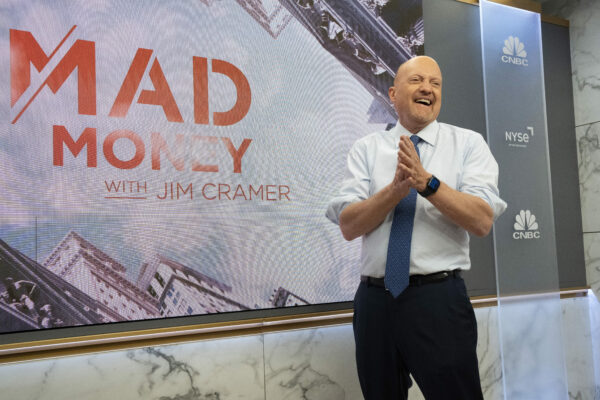

This article was originally published by a www.cnbc.com

Read it HERE