Japan intervened in the forex market – report

The report cites a source.

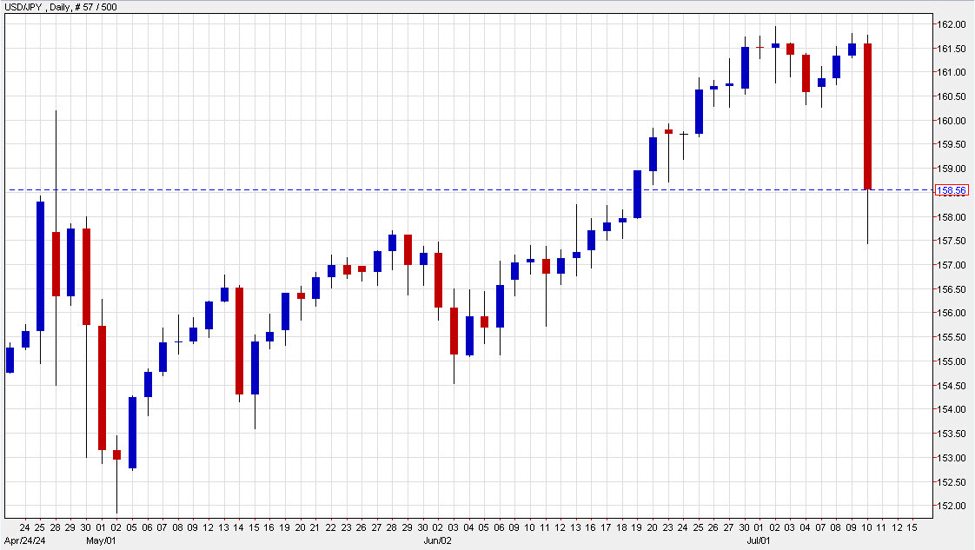

Atsushi Mimura replaced Masato Kanda in late June as Japan’s top currency diplomat and we’ve been eagerly awaiting a new strategy. Kanda relied heavily on verbal intervention and then tried to squeeze the market after it blew through higher levels. He ultimately spent $60 billion in a temporarily successful intervention that knocked USD/JPY down by 800 pips.

It later recovered though and I don’t think that playbook would have been as successful a second time.

Enter Mimura. The new strategy appears to be to wait for help — this time from US data — and go with the momentum. I’ve written about this strategy several times and how it’s had more success globally. You want to swim with the current and this is an indication that will be the new policy.

The slip-up here — I think — is that they leaked it (although we certainly suspected it). I would expect dip buyers to jump on this now that it’s clear what happened.

USDJPY daily

At the same time, I now think it’s more-dangerous to hold USD/JPY longs through US data releases — particularly top-tier data. Your risk-reward is heavily skewed towards the downside. That could lead to longer-term specs abandoning this pair and help to do the MoF’s work.

Ultimately, the fundamentals are what they are and that’s why USD/JPY is near 38–year highs. The only thing that can change that is the fundamentals are there is no real momentum around higher rates/inflation in Japan. So the key is the US dollar side and that’s starting to cooperate but it’s a long road.

This article was originally published by a www.forexlive.com

Read it HERE