Five Things to Know in Crypto This Week: Oversupply, ETF Outflows, Ripple

US BTC-Spot ETF Market Ends Four-Week Inflow Streak

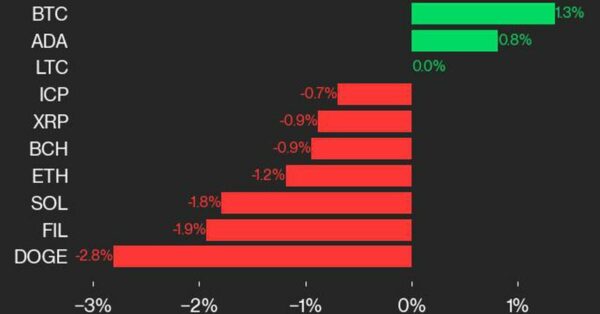

US BTC-spot ETF market flow trends for the week ending August 2 reflected the shift in BTC demand.

According to Farside Investors:

Grayscale Bitcoin Trust (GBTC) saw net outflows of $245.1 million in the week ending August 2 (previous week: -$48.9 million).

Fidelity Wise Origin Bitcoin Fund (FBTC) had net outflows of $192.9 million (PW: +$29.6).

ARK 21Shares Bitcoin ETF (ARKB) Bitwise Bitcoin ETF (BITB) reported net outflows of $122.6 million and $77.1 million, respectively.

Grayscale Bitcoin Mini Trust (BTC) saw net inflows of $219.0 million.

iShares Bitcoin Trust (IBIT) reported net inflows of $327.4 million from Monday to Thursday.

Excluding Friday’s flow data for iShares Bitcoin Trust (IBIT), the US BTC-spot ETF market saw total net outflows of $123.3 million in the week ending August 2.

Significantly, the US BTC-spot ETF market could end its four-week net inflow streak,

Ethereum (ETH) Drops Below $3,000 on ETH-Spot ETF and Supply Trends

Ethereum (ETH) was down 9.61% from Monday, July 29, to Saturday, August 3.

ETH tracked the broader market into negative territory, with US recession jitters impacting demand for riskier assets.

Genesis Trading’s repayment plans contributed to the weekly losses, with the US ETH-spot ETF market unlikely to absorb the oversupply.

The US ETH-spot ETF market faces total net outflows in the week ending August 2

According to Farside Investors:

Grayscale Ethereum Trust (ETHE) saw total net outflows of $603.0 million.

iShares Ethereum Trust (ETHA) had total net inflows of $270.8 million (excluding flow data for Friday).

Fidelity Ethereum Fund (FETH) reported net inflows of $77.7 million, while Grayscale ETH Mini Trust (ETH) saw total net inflows of $36.8 million.

Excluding Friday’s flow data for ETHA, the US ETH-spot ETF market saw total net outflows of $115.1 million for the week ending August 2.

This article was originally published by a www.fxempire.com

Read it HERE