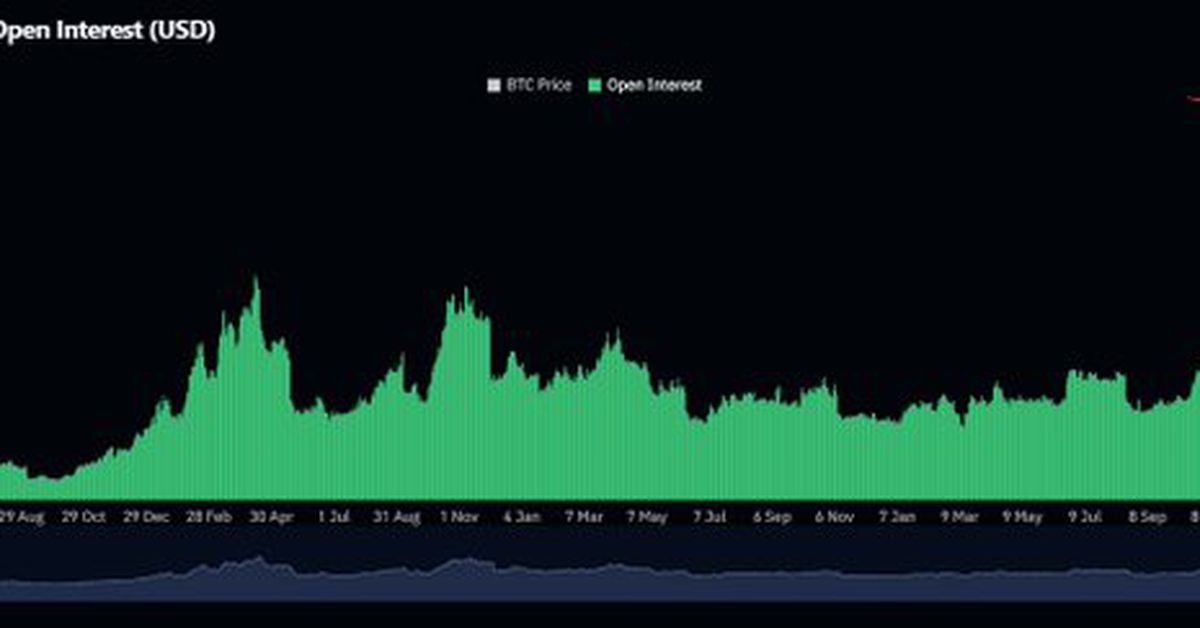

BTC Futures Positions Top Record $37B as Analysts Predict Bitcoin Surge to $83K

Bitcoin traders set a record for futures positions, with open interest surpassing $37.7 billion. The previous record of just under $37 billion was set in March, when bitcoin hit an all-time high of over $73,000. The jump comes a day after spot bitcoin ETFs extended their net inflows streak to 18 days, also a record. The long-short ratio in BTC futures surpassed 1, meaning there are more positions betting on the price rising than declining. BTC is currently priced at around $71,340, an increase of 0.5% in the last 24 hours. The CoinDesk 20 Index (CD20), has dipped by around 0.2%.

Bitcoin could be primed for a surge to $83,000, according to analysis by 10x Research. The breakout is contingent on BTC moving above $72,000 to complete an inverted head-and-shoulders pattern in which an asset experiences three price troughs with the middle one being the deepest. This pattern suggests it is “only a matter of time” before the BTC price reaches a new high, 10x founder Markus Thielen said. A breakout above $72,000, a mere 1% climb above its current price of around $71,300, may hinge on U.S. nonfarm payrolls data, scheduled for release at 08:30 ET. Weak data may strengthen the case for Fed interest-rate cuts, adding to upward momentum in risk assets, including cryptocurrencies.

Health-care company Semler Scientific, which has previously extended its corporate strategy to buying bitcoin, said on Thursday it is purchasing $17 million worth of BTC and preparing to raise $150 million so it can buy more. The company’s 828 bitcoin were acquired for $57 million and are now worth $59 million, according to market data from CoinDesk Indices. Collectively, publicly listed companies hold 308,442 BTC worth approximately $21.8 billion on their balance sheets, according to bitcointreasuries.net. Semler’s announcement in late May that it was purchasing $40 million in bitcoin sent its stock up 25%. SMLR shares have risen just over 3% in pre-market trading.

This article was originally published by a www.coindesk.com

Read it HERE