Bitcoin is above $71,000 as investors keep pouring into the spot Bitcoin ETFs

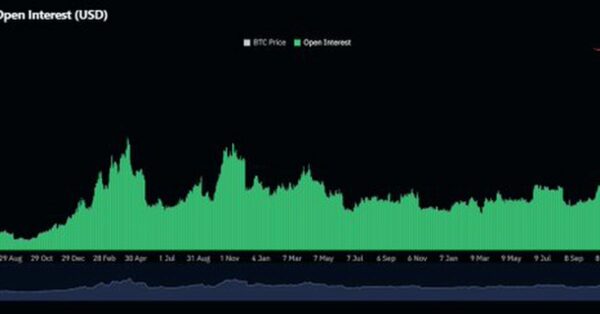

Investors are continuing to pour into spot Bitcoin ETFs, making Wednesday the best day since March, with the top cryptocurrency Bitcoin trading above $71,000 in the morning hours.

According to Bitcoin ETF tracker Farside, the spot Bitcoin ETFs saw over $880 million in inflows on Tuesday. Fidelity’s FBTC saw $378 million in inflows, the highest among all spot Bitcoin ETFs, followed by BlackRock’s IBIT, which saw a $270 million inflow. Grayscale’s GBTC, which has a history of seeing outflows, also attracted investors with $28 million.

The spot Bitcoin ETFs were approved in January by the SEC, and it has since been boosting and revitalizing the crypto market. Following that, the U.K.’s finance watchdog allowed investment exchanges to list crypto-linked exchange-traded notes (or ETNs). Recently, Hong Kong gave the green signal to Bitcoin ETFs, and earlier this week, Australia got its first Bitcoin ETF. Moreover, the SEC gave the go-ahead to eight spot Ether ETFs last month in its landmark decision. As a result of the authorities’ approval, investor confidence has risen, causing a boom in the crypto market.

Neil Roarty, an analyst at the investment platform Stocklytics, said in an email that institutional investors will remain bullish on Bitcoin if interest rates also decrease.

“If we see [interest rate] cuts sooner rather than later, the strong returns Bitcoin has been delivering lately could look even more appealing versus more traditional – and perhaps safer – investments,” he said. “As always seems to be the case with Bitcoin, the only guarantee is that we’re in for an unpredictable ride.”

The bullish sentiment spread across the crypto market on Wednesday morning, with the second-largest cryptocurrency, Ether, hovering around $3,800. Solana’s price jumped 3.5%, trading around $172, while Dogecoin was up nearly 2%, trading at $0.16. Overall, the global crypto market was up nearly 3%, at $2.63 trillion, according to CoinMarketCap.

This article was originally published by a qz.com

Read it HERE