Bitcoin (BTC) Price Bottom Is Near as Miners Capitulating Near FTX Implosion

Bitcoin (BTC) miners are showing signs of capitulation, an event that is typically tied to a market bottom after the world’s largest cryptocurrency endured a 13% plight over the past 30 days.

Bitcoin is currently trading at $60,300 after sliding by 3% on Wednesday. This level has acted as a critical support since April, with bitcoin bouncing three times from this region before heading back towards the $70,000 mark.

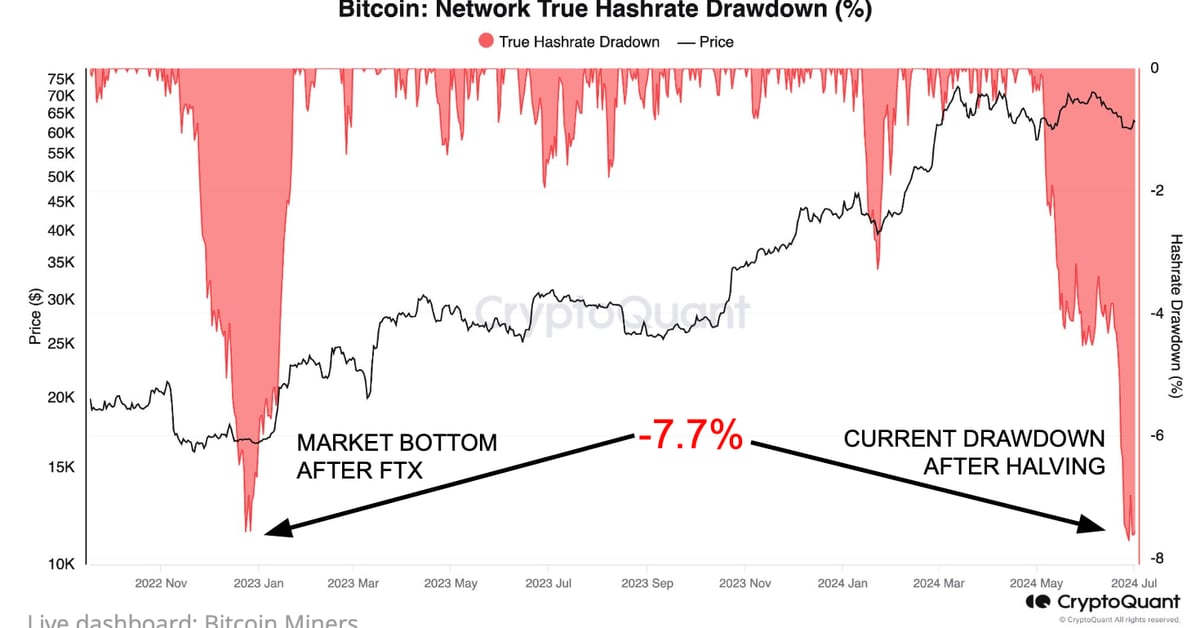

Two signs of miner capitulation are dwindling hashrate and mining revenue by hash (hashprice), both of which are down significantly this month, with hash rate plunging by 7.7% since the halving at hashprice nearing all-time lows. Hashrate is the mining power in the Bitcoin network, and hash price refers to the revenue miners earn from a unit of hashrate.

Miners are also experiencing a hit to their daily revenue, which fell to $29 million today from $79 million on March 6. This has led to miners turning off equipment and the subsequent drop in hashrate.

“Miners have been hit by a 63% decline in daily revenues due to the halving and the collapse of transaction fees to 3.2% of total revenue,” CryptoQuant said in a report.

Miner capitulation levels are now comparable with those in December 2022, which was the market bottom following the demise of FTX.

This article was originally published by a www.coindesk.com

Read it HERE