Algos are taking over institutional forex dealing, but there’s an opportunity

Algorithms now handle more than 75% of the trading in spot markets for FX and those numbers are accelerating as trading desks roll out more and more software for clients.

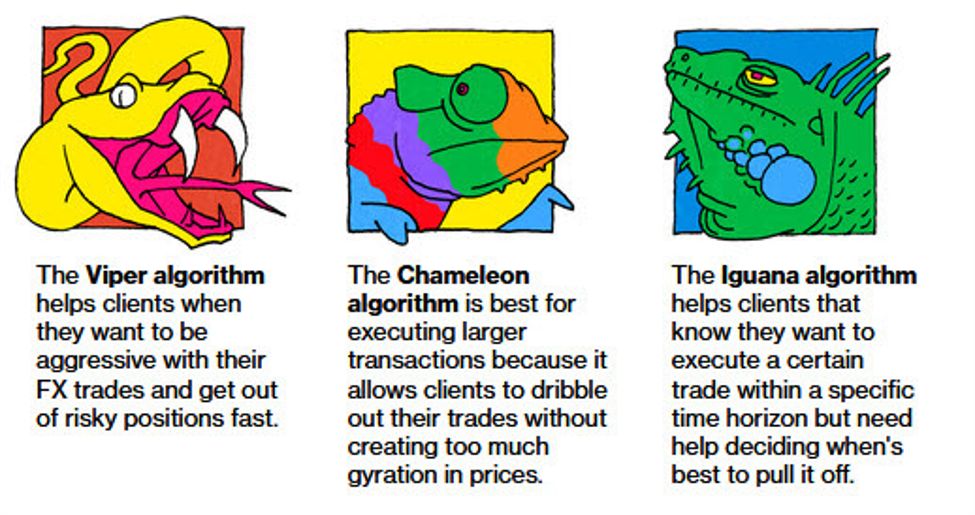

Bloomberg on Sunday wrote about Viper, Iguana and Chameleon — three algos at BNP Paribas that are executing an increasing number of orders. Rather than have a human rely on experience, clients are increasingly turning to the algos to convert currencies.

The report highlights that at Citi, the volume of algorithmic trading it does with regional banks increased 200% year-over-year in January. Hedge funds are also using the products with Deutsche Bank reporting FX volumes in those products up 40% y/y in Q4.

Those numbers are squeezing margins at FX desks (and ultimately jobs) but the report also highlights the dangers of over-reliance. The algos are switched off when macro events hit or liquidity dries up.

“The problem with algorithms is that when there’s a catalytic event, liquidity dries up in a heartbeat,” said Joseph Pach, a former head of currency trading at a Bank of New York Mellon Corp.

subsidiary. He now runs San Francisco-based Corcovado Investment

Advisors. “When you have institutions that have very little appetite to

take risk and their algorithms tend to be very sensitive to news, if

something happens you can get these kinds of flash crash type of

events.”

It’s been years since there many real opportunities in scheduled news in the forex market — or at least short-term opportunities. But as FX increasingly heads towards algos, the dead zones and big moves in illiquid markets will offer some big opportunities.

This article was originally published by a www.forexlive.com

Read it HERE