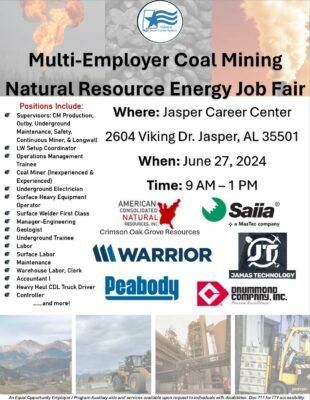

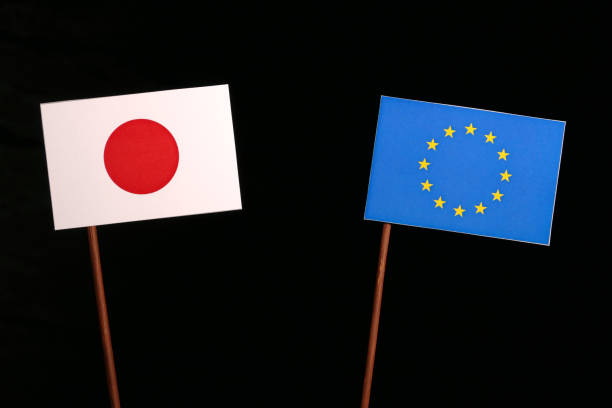

EURJPY Trades Sideways Ahead of Key Events

EURJPY is hovering below the recent 171.56 high

Yen failed to benefit from Monday’s euro weakness

Momentum indicators point to weakening bullish pressure

EURJPY is trading sideways today as the yen has failed to benefit from the euro’s weakness following Sunday’s European parliamentary election results. The pair is still hovering close to its recent 171.56 high with Japanese officials probably feeling a bit more relaxed compared to the end-April market pressure.

This week’s BoJ meeting could prove critical for the short-term outlook of EURJPY as the lack of hawkish commentary on Friday could give the green light to market participants to retest the BoJ’s intervention appetite.

In the meantime, momentum indicators show diminishing bullish pressure. More specifically, the RSI is just above its midpoint and the Average Directional Movement Index (ADX) is signaling an aggressively weakening bullish trend in EURJPY. More importantly, the stochastic oscillator is tentatively hovering above its midpoint and confirming that most participants are probably waiting on the sidelines ahead of this week’s key events.

Should the bulls remain confident, they would try to push EURJPY comfortably above the July 13, 2007 high at 168.93 and gradually lay the foundations for a retest of the April 29, 2024 high at 171.56.

On the other hand, the bears are desperate to recoup part of their significant losses. They could attempt to push the EURJPY below both the 168.93 level and the 50-day simple moving average (SMA) at 167.27. If successful, they could then test their determination against the much busier 164.29-164.97 area, which is populated by the April 23, 2008 high, the November 16, 2023 high and the 100-day SMA.

To sum up, the bulls remain optimistic as the euro’s widespread underperformance has not impacted EURJPY. They are now possibly preparing for another round of bullish pressure if market events allow it.

This article was originally published by a www.actionforex.com

Read it HERE