S&P 500 to fall by 10% by end of September, so get defensive: Stifel

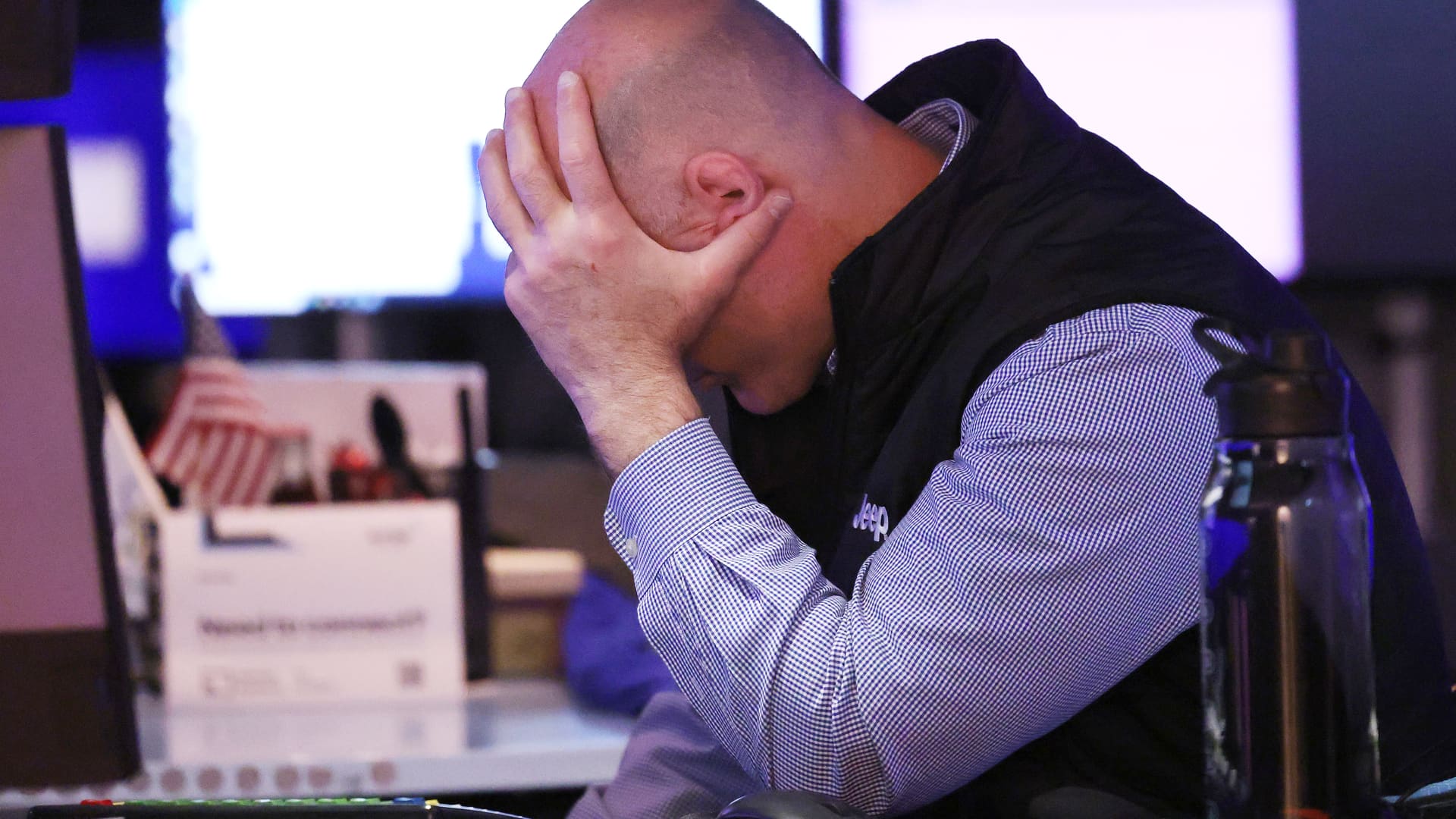

Investors should position themselves defensively as the S & P 500 could drop about 10% before the end of September, according to Stifel Financial. Chief equity strategist Barry Bannister said the broad market index may fall to approximately 4,750 before the end of the third quarter. That would mark a more than 10% decline from where the S & P 500 finished Monday’s trading session. His bearish outlook comes at a time when some are questioning if the market can keep reaching new all-time highs, or if it is due for a consolidation. If the index slid to 4,750, it would have given up all of its 2024 gains after climbing more than 10% this year. The S & P 500 closed out 2023 at about 4,770. .SPX YTD mountain S & P 500, year to date Central to Bannister’s call is a moderate case of “stagflation,” where inflation stays elevated while economic growth stagnates. Bannister said sticky inflation should continue as a concern in the second half of the year, forcing the Federal Reserve to delay cutting interest rate cuts in 2024. That can, in turn, push the S & P 500 price-to-earnings multiple down by about two points, weighing on the stock market. “The no-landing (albeit with soft growth) scenario and increased resource utilization with stickier-than-expected inflation (a moderate form of stagflation) places constraints on the Federal Reserve which outweigh their preference to ease,” Bannister wrote to clients. The S & P 500’s price return when adjusted for inflation, using the consumer price index, is additional cause for concern. Discounted for inflation, the S & P 500 is slightly below where it was about two and a half years ago. The lack of new highs using this yardstick is “emblematic of underlying problems,” the strategist said. Though cyclical value stocks did well early in the year, Bannister recommended pivoting to defensive value companies now to be ready for a correction through the end of the third quarter. Specifically, he pointed to health care, consumer staples, utilities and quality stocks as those that can best weather the coming storm.

This article was originally published by a www.cnbc.com

Read it HERE