3M Stock Price Jumps 20% to Two-Year High on Strong Earnings, Guidance

Shares of 3M (MMM) soared Friday after the maker of a wide array of commercial and consumer products reported better-than-anticipated results and raised its outlook.

The company behind Post-it Notes and Scotch tape reported second-quarter adjusted earnings per share of $1.93 and revenue $6.26 billion, but of which handily topped analysts’ estimates. Organic sales were up 1.2%.

New CEO William Brown, who took over on May 1, said that he was focused on “driving sustained organic revenue growth, increasing operational performance, and effectively deploying capital.”

The company boosted its full-year adjusted EPS estimate to a range of $7.00 to $7.30, up from the earlier $6.80 to $7.30.

Stock Powers Surge in Dow Industrials

Last year, 3M reached legal settlements in class-action lawsuits over so-called “forever chemicals” for $10.3 billion, and military earplugs for $6 billion. This year, it spun off its Solventum (SOLV) health care unit.

Shortly after Brown got the job, Bank of America upgraded the stock, saying it was optimistic Brown would be “refocusing the company on growth and operations” after clearing up the lawsuits and Solventum spinoff.

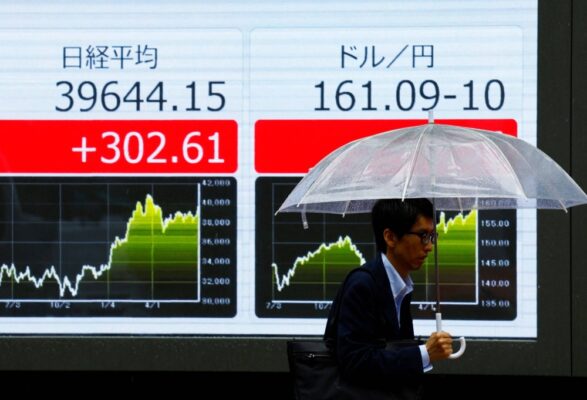

3M shares were up 19.9% at $123.98 around midday Friday, trading at their highest level since August 2022. The stock’s surge was powering a 700-point gain for the Dow Jones Industrial Average.

TradingView

This article was originally published by a www.investopedia.com

Read it HERE